题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Income and education both ______ in determining one's smoking habit.A、bring upB、figu

A.bring up

B.figure out

C.play a part

D.pay off

答案

答案

请输入或粘贴题目内容

搜题

请输入或粘贴题目内容

搜题

拍照、语音搜题,请扫码下载APP

拍照、语音搜题,请扫码下载APP

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.bring up

B.figure out

C.play a part

D.pay off

答案

答案

更多“Income and education both ______ in determining one's smoking habit.A、bring upB、figu”相关的问题

更多“Income and education both ______ in determining one's smoking habit.A、bring upB、figu”相关的问题

第1题

PERSONAL INCOME TAX RATE (MONTHLY) (_VALID FROM SEPT. 1, 2011_) bracket grading tax rate (%) (TR) simple coefficient (SC) 1 less than 1,500 3 0 2 1,500-4,500 10 105 3 4,500-9,000 20 555 4 9,000-35,000 25 1005 5 35,000-55,000 30 2755 6 55,000-80,000 35 5505 7 Over 80,000 45 13505 NoteTax=(income -3500)*TR-SC The above chart shows individual income tax in China. The tax free threshold is 3,500 RMB per month. The tax rates are divided into 7 brackets. The lowest rate is 3% for income between 3,501 and 5,000, while the highest rate is 45% for income over 80,000. Therefore, the higher our income is, the more tax we should pay. ? Tax, which can be used in public services such as education, road construction, public health and so on, is very important to our country. As we all know, tax makes up a great part of our country’s revenue, and the development of our country depends on it. ? From what has been discussed above, we can see that it is everyone’s legal duty to pay tax because taxes contribute to the country and create benefits for everyone. Those who try to evade taxation are sure to be punished. In short, paying tax is our responsibility to society. DECIDE IF EACH OF THE FOLLOWING STATEMENTS IS TRUE (T) OR FALSE (F).

1. The purpose of the passage is to help people know the tips how to pay less tax.()

2. According to the chart, if a person’s monthly is 3600 yuan, he/she doesn’t need to pay tax.()

3. How much income tax a person pays each month depends on how much his/her income is.()

4. The underlined word “evade” in the last paragraph means increase.()

5. Personal income taxes are included in a government’s revenue.()

第2题

A.Many sociologists and government officials have argued that poverty in the US is understated.

B.The poverty line lost all connection over time with current consumption patterns of the average family.

C.The issue of understating poverty is especially pressing in the states with both a high cost and a high poverty rate such as California.

D.The official poverty line today is essentially what it takes in today's dollars to purchase the same poverty-line level of living half a century ago.

第3题

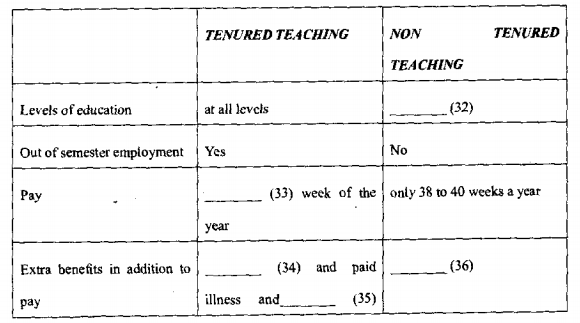

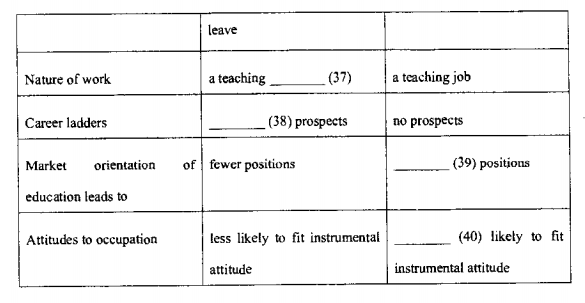

阅读理解Education as a career or a job

Do you want to become a teacher? If you do, then you should recognise that in England, the US and other Western countries, the term •teacher' covers a wide range of jobs which can be seen as forming an occupational hierarchy ranging from high status, high income careers to lower paid positions.

At all levels of education, university, school and kindergarten, there are a mixture of well paid, secure careers with prornotional prospects and casual jobs with no prospects. In education, if a job is a secure one, it is called tenured. If it is casual work, it is called non-tenured. Non-tenured jobs in education are paid well whilst the person is working; but out of the semester, i. e. for twelve or fourteen weeks of the year, the worker gets no employment. The tenured teacher or lecturer gets paid for every week of the year, even over the long school or university holidays. They also get extra payments that the non-tenured people do not receive. For example, they receive contributions from their employer that go towards their superannuation fund. They also get paid if they become ill or need maternity leave. When the teacher or lecturer is tenured, she or he is regarded as having a career, but the non-tenured worker is often regarded as just having a job.

The level of academic qualification and the extent of teaching experience will largely determine where a person is placed in the teaching hierarchy. However, in England now the government is asking universities to be more market-oriented and to plan research pmjects and create courses that will sell on the open market. Now that universities in England are o moving toward a more market oriented status, they are trying to find ways to save money and there is great pressure to employ more lecturers on a casual not a tenured basis.

Why do people want to become lecrurers or teachers? There is a lot of in the study of occupational choice. Many occupations have been studied to determine why people chose a particular occupation. In education, two general findings emerged: some people feel that they have a mission to teach and want to be a successful teacher, whereas others have a purely instrumental approach. An instrumental approach means that teacbing is chosen not to fulfill a lifetime ambition but just as way of earning a living. This instrumental approach is likely to develop with the casuälisation of education.

第5题

对下面的个人所得税程序中满足语句覆盖测试用例的是()。 If(income<800) taxrate=0; else if(income<=1500) taxrate=0.05; else if(income<2000) taxrate=0.08; else taxrate= 0.1;

A.“income=(800,801,1999,2000)”

B.“income=(800,1500,2000,2001)”

C.“income=(799,1500,1999,2000)”

D.“income=(799,1499,2000,2001)”